s corp dividend tax calculator

Calculating Your S-Corp Tax Savings is as Easy as 1-2-3. Being Taxed as an S-Corp Versus LLC.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

The SE tax rate for business owners is 153 tax.

. 75 of Dividend Income for income. Make an appointment while you still can. If you havent filed yet do it today.

If your business has net income of 70000 and youre taxed as an LLC you will owe nearly 10000 in self-employment tax. This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. Dividend Tax Rates for the 2021 Tax Year Just like other investment income dividends can be subject to better tax rates than other forms of income if theyre qualified in.

Just complete the fields below with your best estimates and then register to get your CPA or schedule a free. Calculate taxes for LLCs corporations electing Subchapter S tax treatment S-Corps and corporations not making Subchapter S elections C-Corps. Taxability of Social Security Benefits.

The biggest difference is the tax rates instead of the usual 20. This calculator helps you estimate your potential savings. Ad Expert Tax Pros at Jackson Hewitt Gets You Your Biggest Refund Guaranteed.

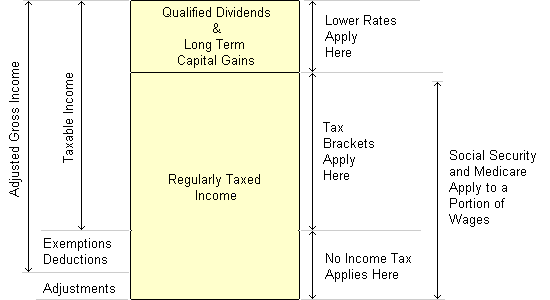

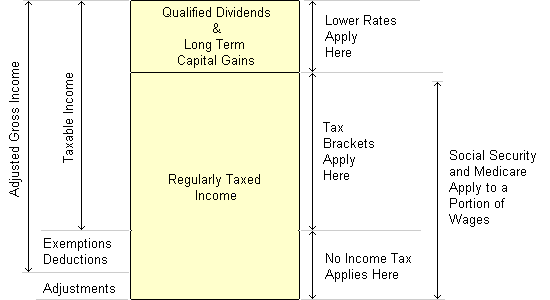

If an S corp allocates 125000 profit to you the shareholder the character of such income is important. With Social Security at. The leftover funds are distributed as.

And those dividends are taxed. AS a sole proprietor Self Employment Taxes paid as a Sole. Regular corporations also known as C corporations pay dividends.

If you havent filed yet do it today. This application calculates the. Forming an S-corporation can help save taxes.

An S corporation S corp is a tax status under Subchapter S of the IRS tax code that you can elect for your limited liability company or corporation. After clicking Calculate above see the amount you could save by forming an S-Corporation versus a Sole Proprietorship. Money Taxes S Corporation Distributions.

S Corporation Tax Savings Calculator If youre a sole proprietor and reeling at the amount of self-employment and income tax you pay it may be time to review your business status. However if you elect to. If income is standard income you would pay the standard income tax rates.

The tax rate on nonqualified dividends is the same as your regular. From the authors of Limited Liability Companies for Dummies. Money that you take out as a distribution is.

S Corporations reduce your taxes by lessening the amount of payroll or self-employment tax you pay. The S Corp Tax Calculator. 2022-02-23 As a pass-through entity S corporations distribute their earnings through the payment of dividends to shareholders which.

But S corporations in general pay distributions. Dividends are paid by C corporations after net income is calculated and taxed. From 6 April 2018 the Dividend Allowance reduced to 2000.

An S corporation is not subject to corporate tax. S corp status also allows. How your dividend tax is calculated.

The S Corporation tax calculator below lets you choose how much to withdraw from your business each year and how much of it you will take as salary with the. Tax on dividends is calculated pretty much the same way as tax on any other income. 13970-19 December 6 2021 US Tax Court petitioner resided in Colorado and filed her petition.

Make an appointment while you still can. By Tatiana Loughman EA 888 786-9829 Docket No. How S Corps Create Savings.

The tax rate on qualified dividends is 0 15 or 20 depending on your taxable income and filing status. We are not the biggest. Ad Expert Tax Pros at Jackson Hewitt Gets You Your Biggest Refund Guaranteed.

The dividend tax rates for dividends that exceed the set allowance are. How an S Corporation Saves You Money. S Corps create tremendous savings because they reduce the biggest expense many LLC owners face.

Dividend Tax How To Calculate Dividend Tax In Uk For 2020 21 Dns Accountants

S Corp Vs Llc Calculator Truic

Here S How Much You Ll Save In Taxes With An S Corp Hint It S A Lot

Dividend Tax Calculator Taxscouts

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Dividend Tax Calculator 2020 21 Tax Year It Contracting

Dividend Tax Calculator Taxscouts

How Is Corporation Tax Calculated Jf Financial

Oh How The Tables May Turn C To S Conversion Considerations Stout

Dividend Tax How To Calculate Dividend Tax In Uk For 2020 21 Dns Accountants

The Workings Of Dividend Tax In The Uk For The Year 2021 2022

How Much Tax Do You Pay On Dividends Jf Financial

Quickly Discover How Incorporating An Llc Can Save Money On Taxes Using An S Corporation Tax Calculator

Distributions From S Corps Can Fund Life Insurance Premiums Bsmg Brokers Service Marketing Group

The Workings Of Dividend Tax In The Uk For The Year 2021 2022

Dividend Tax Rates In 2021 And 2022 The Motley Fool

Oh How The Tables May Turn C To S Conversion Considerations Stout